The Fed cuts rates, increasing gold’s allure

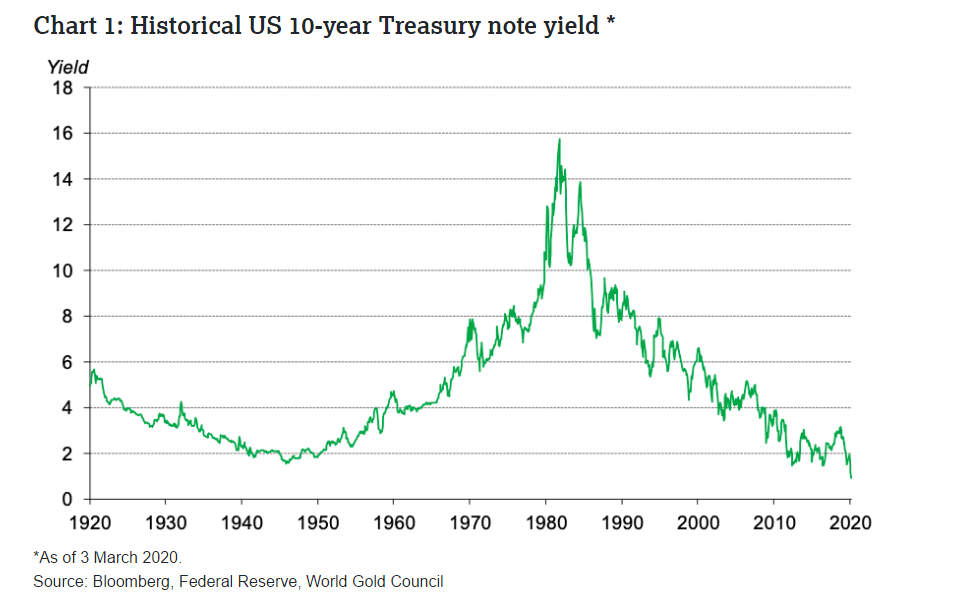

The US Federal Reserve (Fed) announced an emergency 50bp rate cut yesterday, bringing the Fed funds rate down to a 1-1.25% range, in response to ongoing concerns about the potential impact of the coronavirus outbreak to the global economy. Treasury bond rates followed suit, with the 10-year note hovering 1% at the time of writing – an all-time historical low (Chart 1). 1

The unscheduled rate cut is not unprecedented: the Fed cut rates by 50bp in January 2008 in between meetings as issues surrounding the US housing market started to mount. But, at the time, the funds rate was above 4%, giving the Fed greater firepower for further future cuts. Their margin for more cuts is now far slimmer and may require them to resort to alternative policy tools – a fact the markets seem to recognize. After an initial positive burst on the news of the cut, the US stock market gave back its gains as the day progressed. Year-to-date, most major US stock indices are down by 3% or more.2 The stock market may behave differently later in the week, but in our view, yesterday’s performance speaks to the potential concerns investors might have on: 1) the impact of the outbreak on the real economy; and 2) the effectiveness of a rate cut to limit such impact.

In contrast, the gold price has soared so far in 2020, reaching an intra-day high of US$1,650/oz yesterday and increasing by almost 7.5% year-to-date – one of the best performing asset classes (Chart 2). Our analysis suggests that investors have been adding gold to their portfolios to hedge an increasingly volatile environment – 30-day volatility for the S&P 500 has jumped to more than 27%, double last year’s average – with the coronavirus outbreak the latest addition to a long list.

The rate cut should further support gold investment demand, even if consumer demand softens. In fact, our research suggests that the gold price has historically increased by twice its long-term average in periods of negative interest rates (Table 1), such as the one we are currently in. To that extent, investors may consider replacing part of their bond exposure with gold to help more effectively hedge stock market risk.

Table 1: Gold performance nearly doubles in periods of negative interest rates

Gold performance in various real rate environments*

Footnotes

1 wsj.com/articles/yield-on-10-year-treasury-note-reaches...

2 As of 3 March 2020. Based the levels of the S&P 500, DJIA and NASDAQ indices at the time of writing.

责任编辑:闫梅