Central bank demand remains on course for remarkable 2019

Happy new year to you all.

While the entire world is looking forward (for the most part) to what is in store for 2020, we are still busy working on assessing how gold demand ended in 2019. Part of this involves updating our central bank gold reserves data set to end-November, which we have published today.

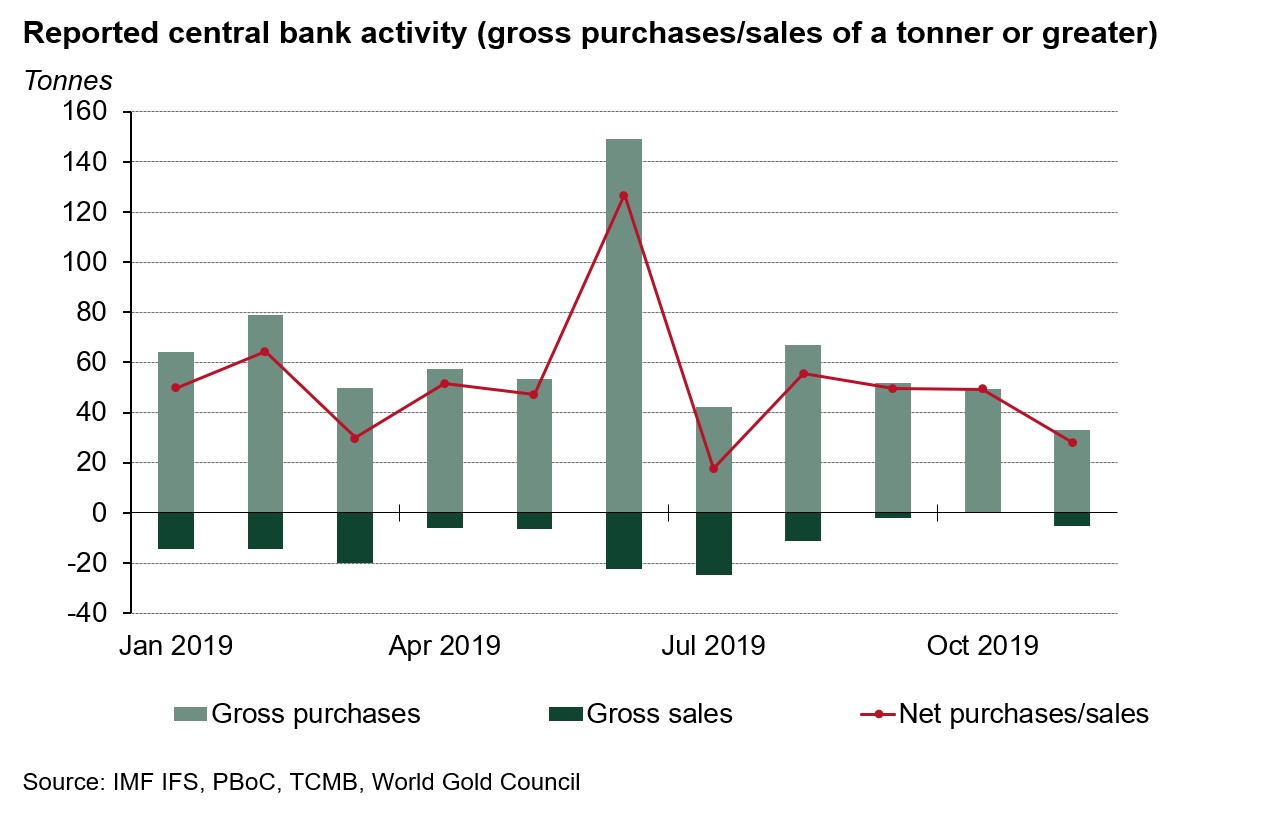

In November, central banks reported adding 27.9 tonnes – on a net basis – to global official gold reserves, 43% lower than October’s increase. On a year-to-date basis, this brings cumulative net purchases to 570.2t, 11% higher the same period in 2018 (515.2t).1

Purchasers were relatively scarce in November, with only four central banks increasing their gold reserves by a tonne or more. Turkey (17t), Russia (9.4t), Kazakhstan (4.6t) and Mongolia (2t) were the familiar faces in the purchaser’s column. On the net sales side, only Colombia saw reserves decline significantly (5.1t).

While November was the second lowest level of buying so far in 2019 (July was the lowest), the scale of purchases year-to-date remains remarkable. Following the 50-year high in 2018, few (including us) expected the buying strength we have seen. Look out for our Full Year 2019 Gold Demand Trends report in a few weeks, which will provide a complete assessment of central bank gold demand in 2019.

Footnotes

1 All calculations include net purchases/sales of a tonne or more only.